Check Free Cibil score | Get Free credit report | Fincover®

Check

your Credit Score Worth Rs.1000**

absolutely free**

View your personalized credit health report and loan offers in a few steps, Apply for Low-Interest Loan and Lifetime Free Credit Card Today!

What is a Credit Score?

A credit score is a measure of a person’s creditworthiness. It’s a numerical figure that falls in the range of 300-900. It is useful while ascertaining the ability of the person to repay the borrowed amount.

The government calculates credit Scores using authorized agencies. It depends on various factors like repayment records, length of credit history, inquiries made for loans, etc.

Whenever you apply for a loan or a credit card, the concerned entity verifies your score and takes a decision based on it. A higher score entails benefits such as credit cards with a higher limit, large loan amounts, and low-interest rates.

Suggested Read – How Is My Credit Score Calculated?

What is a Good Credit Score in India?

In India, a good credit score is typically considered to be around 750 or above. Credit scores in India are measured on a scale that ranges from 300 to 900, with higher scores indicating better creditworthiness. While the specific definition of a “good” score may vary slightly among different lenders and bureaus, a score of 750 or higher is generally seen as favorable and can offer several benefits. A credit score is commonly referred as the CIBIL score among public though there are other credit bureaus offering scores as well.

Excellent (750 - 900)

A score within this range reflects excellent creditworthiness. Borrowers in this range are likely to get the best loan terms and interest rates.

Good (700 - 749)

A good credit score suggests responsible behavior and enhances the chances of loan approval at favorable terms.

Fair (650 - 699)

While borrowers in this range might still qualify for loans, they might not receive the most competitive rates.

Poor (550 - 649)

Individuals with scores in this range may face challenges in obtaining loans, and if approved, they might face higher interest rates.

Very Poor (300 - 549)

A score in this range indicates significant credit risk, making it difficult to secure loans or credit at reasonable terms.

NA

NA is for the person without any credit history.

Companies computing the credit score

RBI authorizes Credit information companies to compute your credit scores. In India, four companies compute your credit scores. CIBIL, Experian, CRIF High Mark, and Equifax are the companies that are calculating your credit scores.

Banks send the transactions that you make which are pertaining your credit score to all these four bureaus. These companies have an up to date record of your transactions. If a bank needs to verify your credit score, they can contact any of these four bureaus. The scores are equal in each of your companies as they follow the same guidelines to calculate your score. The scores calculated may vary between the four bureaus.

After receiving the information about transactions from banks, these bureaus collect more information about financial habits from other banks and financial institutions. Based on this information, they generate a credit report. A credit report is an equivalent of a mark card.

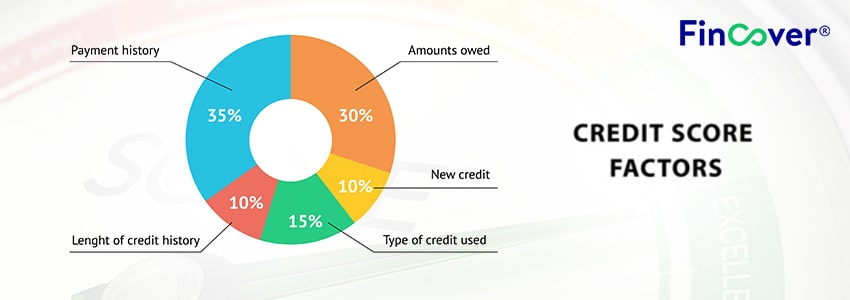

Factors influencing the credit score

Credit information companies calculate the Credit Score of an individual after taking into consideration several factors. Payment history, repayment behaviour, types of loans, and the tenure are some of the factors that have a say on your credit score. The financial institutions from where you are transacting send your monthly details to these bureaus. Every company has its methodology of calculating these scores.

Payment History

Timely payments on credit accounts are crucial. Late payments can significantly impact your score

Payment History

Timely payments on credit accounts are crucial. Late payments can significantly impact your score

Credit Utilization

This ratio represents the amount of available credit you’re using. Keeping it below 30% is advisable

Credit Utilization

This ratio represents the amount of available credit you’re using. Keeping it below 30% is advisable

Age of the credit

A long credit history lends an advantage as it better insights about your repaying capacity

Age of the credit

A long credit history lends an advantage as it better insights about your repaying capacity

New Credit Accounts

Opening multiple accounts within a short period can raise red flags for lenders

New Credit Accounts

Opening multiple accounts within a short period can raise red flags for lenders

Importance of Cibil Score

A Cibil score will help you gauge your chances of getting loans. Also, a timely check of it will help you notice a dip or any discrepancy in it, due to computational errors. Once you identify a difference in the report, you can always take steps to correct them at your convenience.

Strategies for Boosting Your Credit Score

There are multiple benefits to having a good Cibil score. Listed below are some of the Strategies

Pay Bills on Time

Prompt payments are the cornerstone of a good credit score. Set up automatic payments or reminders to ensure you never miss a due date.

Monitor Your Credit Report

Regularly review your credit report for inaccuracies or discrepancies. Report any errors promptly to the credit bureaus.

Manage Credit Utilization

Maintain a healthy balance between credit limits and balances. Avoid maxing out your credit cards.

Avoid Opening Unnecessary Accounts

While a diverse credit mix is beneficial, opening too many accounts in a short span can be detrimental.

Lengthen Your Credit History

Keep older accounts active and in good standing to demonstrate a history of responsible credit use.

Information in a Credit report

A credit report determines a person’s credit history. The credit report contains details of your accounts like credit cards, loan history, transaction details from a government registered entity. It will also contain statements about your payment history, account balance, and credit limit. A credit report will essentially include these details:

Account Information

This section contains details about the person’s credit history. Following details are present,

∙ Creditor

∙ Current Balance

∙ Monthly Payment History

∙ Account type

∙ Payment status

∙ History of Credit limits

Personal Information

It contains information about your name, address, and date of birth. In the event of any mistakes like misspellings or wrong update of address and DOB, the user must contact the agency to rectify the mistakes.

Inquiries

Here, the number of inquiries made to know an individual’s credit score is displayed. A higher number of inquiries can negatively impact your CIBIL score.

Public Records

It indicates the list of bankruptcies filed by the person and also the tax liens of the customer.

The Role of Credit Inquiries

Hard Inquiries

Hard inquiries occur when a financial institution, such as a lender or credit card issuer, checks your credit report as part of their decision-making process. These inquiries are typically made when you apply for a new credit account, like a loan or a credit card.

Soft Inquiries

Soft inquiries, also known as “soft pulls,” occur when your credit report is accessed for reasons other than a credit application. These inquiries are typically done for background checks, pre-approved credit offers, or by employers during the hiring process.

Why Check your Credit Score at Fincover?

At Fincover, we firmly believe that every individual must have better control over their finances. One way of achieving this would be to make them know their credit score. Knowing it can help you take well-informed financial decisions.

If you have a good score, then you have a fair chance of getting the best loan offers at attractive interest rates. Your data is absolutely safe, and we will not share your data with any third party. So, you can check your credit scores without any worries.

Knowing your credit score would help you stay on top of your finances. You will get tailored loan offers from numerous banks and NBFCs based on your credit score.

How to obtain your credit report online?

- Visit Fincover.com and select “Credit Score (Free)”

- Click on “Check your credit score button”.

- Enter your First Name and Last Name and click on Next.

- Enter the personal details required such as Address, email ID, City, State, DOB

- Enter your PAN Card number and mobile number.

- Complete the OTP verification.

- Get your credit report.

A credit score plays a significant role in determining the terms and approval of a personal loan. It is a numerical representation of an individual’s creditworthiness and financial history. Lenders use this score to assess the risk associated with lending money. A higher credit score, typically ranging from 700 to 850, indicates responsible financial behavior and will result being in the good books of lenders

A positive credit score results in lower interest rates, higher tenures, and higher loan amount. A lower interest results in overall lower cost of borrowing. Lenders are more willing to lend to people with proven track record of good financial management.

Suggested Reads – Credit Score For Personal Loan

Lenders assess a business’s credit score to gauge its ability to repay borrowed funds. A higher score reflects responsible financial management, making lenders more confident in extending loans. It can also lead to lower interest rates, reducing the cost of borrowing and improving the company’s financial position.

Conversely, a lower business credit score can lead to loan rejections or less favorable terms. Lenders may view businesses with lower scores as riskier borrowers, resulting in higher interest rates or stricter repayment terms.

A low business credit score not only affects loan approval and terms but also impacts the loan amount a business can access. A higher score may enable the business to secure larger loan amounts to support growth initiatives.

Suggested Reads – Credit Score for Business Loan

A credit score has a profound impact on one’s ability to get credit cards. A credit card is an instrument of revolving credit, and a higher credit score greatly influences the terms and privileges associated with it.

A good credit score, typically ranging from 700 to 850, enhances the likelihood of credit card approval. Lenders view individuals with higher scores as more reliable and less risky borrowers, making them eligible for a wider range of credit cards with better rewards, lower interest rates, and higher credit limits.

Moreover, a higher credit score enables individuals to access premium credit cards that offer exclusive benefits such as cash back, travel rewards, and concierge services.

Conversely, a lower credit score can limit credit card options. Individuals with lower scores might face higher interest rates, lower credit limits, and fewer rewards. In some cases, they might even be denied credit cards altogether due to the perceived risk.

Suggested Reads – Credit Score for Credit cards

The impact of a credit score on a home loan is profound, influencing both the interest rates and loan amount. A credit score is as a crucial indicator of an individual’s creditworthiness and how he manages the finances, thereby affecting their ability to avail a home loan

A higher credit score, typically ranging from 700 to 850, enhances the likelihood of home loan approval. Lenders view borrowers with strong credit scores as less risky, making them more inclined to extend loans. Moreover, a higher score often results in more favorable interest rates. Borrowers with good scores are offered lower rates, leading to reduced loan costs in the longer run

Conversely, a lower CIBIL score can lower your home loan approval or lead to less favorable terms. Individuals with lower scores are considered higher risk, prompting lenders to either deny the loan application or impose higher interest rates to compensate for the risk in lending.

Suggested Reads – Credit Score for Home Loan

Personal loans Understanding DPD in CIBIL Report Your Credit Information Report (CIR) provided by Credit

Does PayPal Credit affect your credit score? Quick answer: PayPal Credit can affect your credit

Personal loans Boost Your Credit Score: A Comprehensive Guide to CIBIL Improvement in 2024 A

Credit Score How to fix errors in Credit report? Credit Report Error It is important

Credit Score Does late payment of credit card bills affect your credit score? At times,

Credit Score Credit Score for Home Loan A Own home is a dream of everyone

Credit Score Credit Score for Credit cards Want a credit card in 2024? Many of

Credit Score Credit Score for Business Loan Most businesses require funding at some stage of

Credit Score Credit Score For Personal Loan Personal Loans are unsecured loans. They are sanctioned

Credit Score How Is My Credit Score Calculated? Your credit score in India is a

Personal loans Mastering Credit Utilization: A Step-by-Step Guide Credit utilization is a crucial factor influencing

Personal loans Boost Your Credit Score: 7 Expert Tips A good credit score is essential