UAN Passbook Login & Download

The UAN passbook is your online statement for your Employees’ Provident Fund (EPF) account in India. It acts as a digital record, offering transparency and convenience in managing your retirement savings.

Introduction to UAN Passbook

The Universal Account Number (UAN) Passbook is an essential document for employees enrolled in the Employee Provident Fund (EPF) in India. Managed by the Employees’ Provident Fund Organisation (EPFO), the UAN Passbook provides a detailed record of the contributions made by the employee and their employer towards the EPF account. This valuable tool not only helps in monitoring savings and ensuring transparency but also facilitates easy management of funds. Accessible online, it simplifies the process of checking the EPF balance and tracking the monthly deposits throughout an individual’s career.

Benefits of UAN Passbook

The UAN Passbook is an essential tool for employees to manage their Employee Provident Fund (EPF) accounts efficiently. This digital passbook offers a comprehensive view of the contributions made by both the employee and the employer. Let’s delve into the specific benefits of using the UAN Passbook.

Convenient EPF Balance Tracking

One of the primary advantages of the UAN Passbook is the convenience it provides in tracking the EPF balance. It serves as a digital record that is accessible anytime and anywhere, eliminating the need to visit the EPFO office physically or wait for annual account statements. The balance displayed in the passbook includes the latest approved transactions thus ensuring that the information is up to date. This feature is particularly useful for planning financial commitments and retirement savings.

Easy Monitoring of Contributions

The UAN Passbook simplifies the process of monitoring the monthly contributions toward the EPF account. It lists detailed entries of each contribution, including:

- The monthly contribution amount by the employee and the employer

- The interest amount credited annually to the account

- Any transfer-in amounts from previous accounts, if applicable

This level of detail helps employees ensure that the contributions made are accurate and correspond to the deductions shown in their salary slips. Moreover, it provides transparency and helps in detecting any discrepancies early, which can be rectified without much hassle.

Step-by-Step Guide for UAN Passbook Login

Create Your UAN (Universal Account Number)

If you are newly employed, the first step towards managing your Employee Provident Fund (EPF) online is to obtain your Universal Account Number (UAN). This number is unique to each employee in the organized sector and is provided by the employer. If your employer has not yet shared your UAN, you should inquire with your company’s HR department. After receiving your UAN, ensure that it is activated, as this is crucial for accessing the EPF passbook online.

Activate UAN for Passbook Login

Before you can log in to view your EPF transactions, you need to activate your UAN. Here’s how you can do it:

- Visit the official EPFO website ( https://unifiedportal-mem.epfindia.gov.in/)

- Click on ‘Activate UAN’ under the ‘Important Links’ section.

- Enter your UAN, mobile number, and the details of your ID (such as Aadhaar or PAN) mentioned in your EPF records.

- You will then receive an authorization PIN on your registered mobile number.

- Enter the received PIN to activate your UAN.

Once activated, you will be able to set up your login credentials, including your password, to access the UAN member portal.

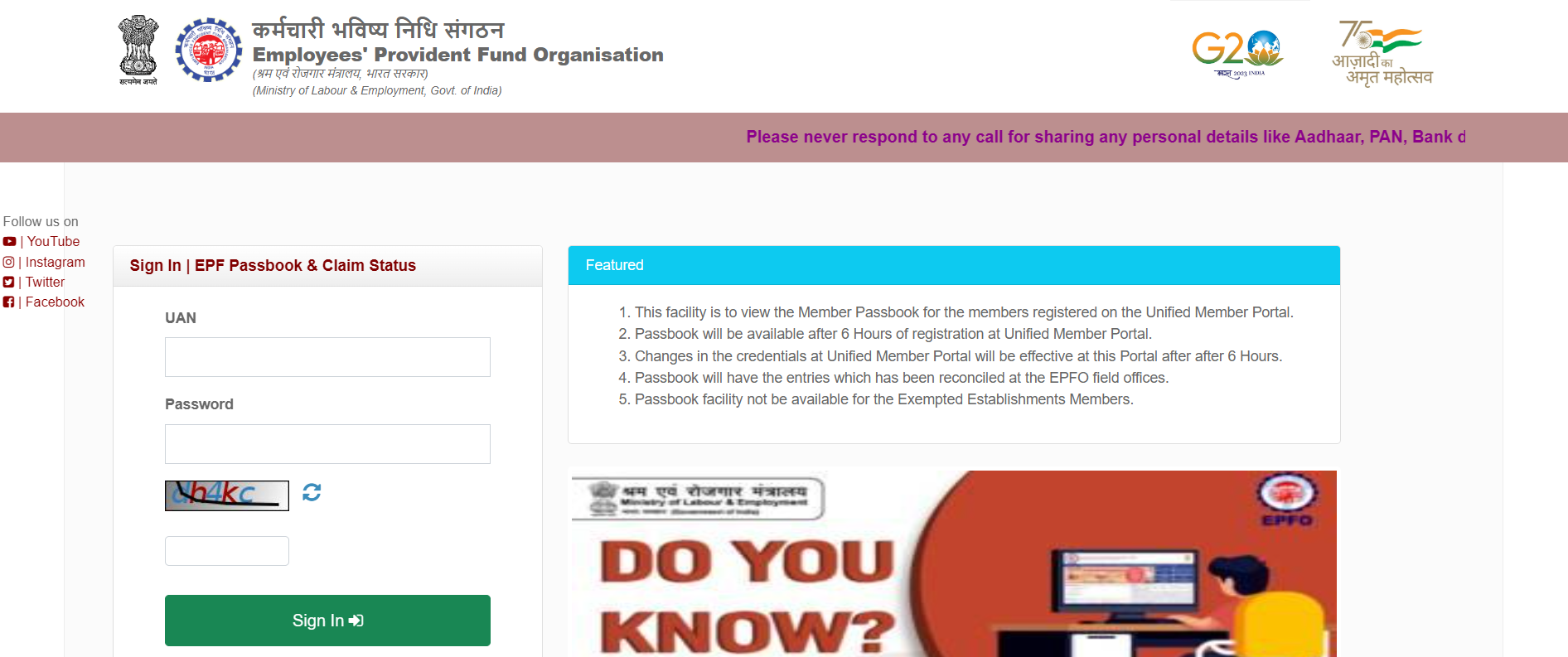

Login to the UAN Passbook Portal

With an activated UAN, logging into the UAN Passbook portal is straightforward:

- Navigate to the EPFO website and go to the ‘For Employees’ section under ‘Our Services’.

- Click on ‘Member Passbook’ under the services list.

- You will be redirected to the UAN Login page.

- Enter your UAN, password, and the Captcha displayed on the screen, then click on ‘Login’.

- Once logged in, you can access your EPF passbook, which contains details of your monthly contributions, employer’s contributions, and accrued interest

Features of the UAN Passbook

The UAN (Universal Account Number) passbook is a vital document for employees covered by the EPFO (Employees’ Provident Fund Organization). It allows them to manage their EPF (Employee Provident Fund) accounts effectively. This online document provides detailed information about an employee’s EPF account, accessible through the EPFO’s official portal. Below are the key features of the UAN Passbook.

Detailed EPF Balance Information

The primary feature of the UAN Passbook is that it offers detailed information about the EPF balance. This includes the total amount accumulated in the EPF account, details of the employee’s and employer’s contributions, and any accrued interest. The passbook is updated every month, ensuring that the information is current and accurately reflects any changes. This level of detail helps employees keep track of their savings and check their fund’s growth over time.

Transaction History

Another important feature of the UAN Passbook is the comprehensive transaction history it provides. This history includes every credit or debit transaction made in the EPF account. Credits generally arise from monthly contributions from the employee and employer, while debits may include withdrawals or advances taken against the EPF balance. This transaction history is crucial for verifying the accuracy of contributions made and ensuring that all financial activities are transparent and accounted for.

Download and Print Facility

The UAN Passbook can be easily downloaded in PDF format from the EPFO portal. This facility makes it convenient for employees to maintain personal records and physically verify their EPF details when required. Furthermore, having a printed copy is helpful during the loan application process, where proof of financial stability and savings is often needed. The ability to download and print the passbook also allows for easy sharing with financial advisors, aiding in better financial planning and management.

Common FAQs about UAN Passbook

1. How often is the Passbook updated?

The UAN passbook is updated monthly, typically reflecting recent contributions, interest accrued, and any withdrawals made. This update generally occurs after the employer deposits the monthly Employee Provident Fund (EPF) contribution into the employee’s account. Since the exact timing can vary based on when the employer makes the deposit, it’s good practice to check your passbook regularly to ensure that all transactions are reflected accurately and promptly.

2. Can the Passbook be accessed offline?

Access to the UAN passbook is primarily available online through the EPFO’s official website or its mobile app. However, for individuals who need offline access, there is an option to download the passbook from the online portal and save a PDF version. This downloaded version can be used for reference when internet access is not available. It is important to regularly update the downloaded copy by downloading the latest version after each passbook update to ensure that the information remains current.

3. Are there any security measures in place?

The EPFO has implemented several security measures to protect users’ data and privacy associated with the UAN passbook. Access to the passbook online requires users to log in with their unique Universal Account Number (UAN) and a password. Additionally, the portal uses standard data encryption techniques to secure communication and personal information. Users are also advised to never share their login credentials and to change their passwords regularly to maintain security.

Tips and Tricks for Efficient Usage of UAN Passbook

Setting up Notifications for Account Activity

One effective way to stay updated with your EPF account activity is to set up notifications. The EPFO provides facilities to receive SMS or email notifications whenever there is a transaction in your account. These notifications alert you about new deposits, withdrawals, or other significant account activities. To enable this feature, you can log in to your EPFO member portal and select the notification preferences under your profile settings. This proactive step helps in keeping track of all the activities and ensures timely awareness of any discrepancies.

Regularly Verifying Information for Accuracy

Regular verification of your UAN passbook information is crucial for maintaining the accuracy of your EPF account. Periodically log in to your EPFO account to check your passbook for any anomalies like incorrect employer contributions or missing transactions. If discrepancies are noticed, report them immediately to your employer or directly to the EPFO through their grievance redressal system. Additionally, make sure your details like name, date of birth, and linked bank account are up to date to prevent any issues during withdrawal or transfer of funds. Conducting these checks not only helps in efficient financial planning but also secures your savings for the future.