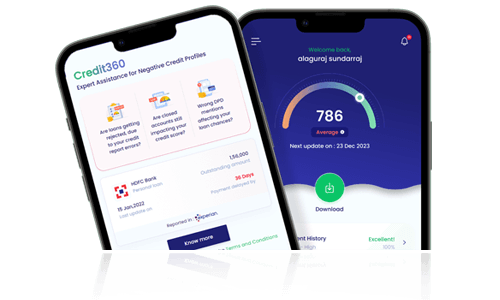

Credit360 Services

Banks Saying NO to Loans? Credit360 Unlocks Your Hidden Potential! (This option focuses on Credit360’s ability to help people secure loans even with bad credit)

Annual Plan

- Credit score & Report

- Credit Profile Update

- Challenges to top 3 credit bureaus

- Score tracking & Analysis

- Identity theft Protection

- Financial Coaching & Debt Analysis

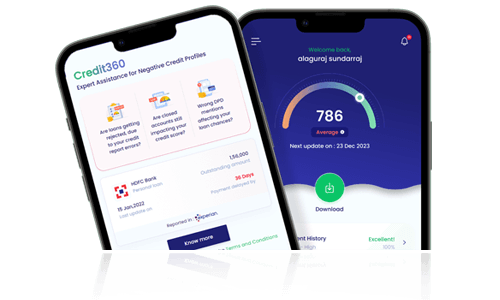

- Access to the credit dashboard

Trusted by

Personalized

Transparent

Data Driven

What is Credit360 Service?

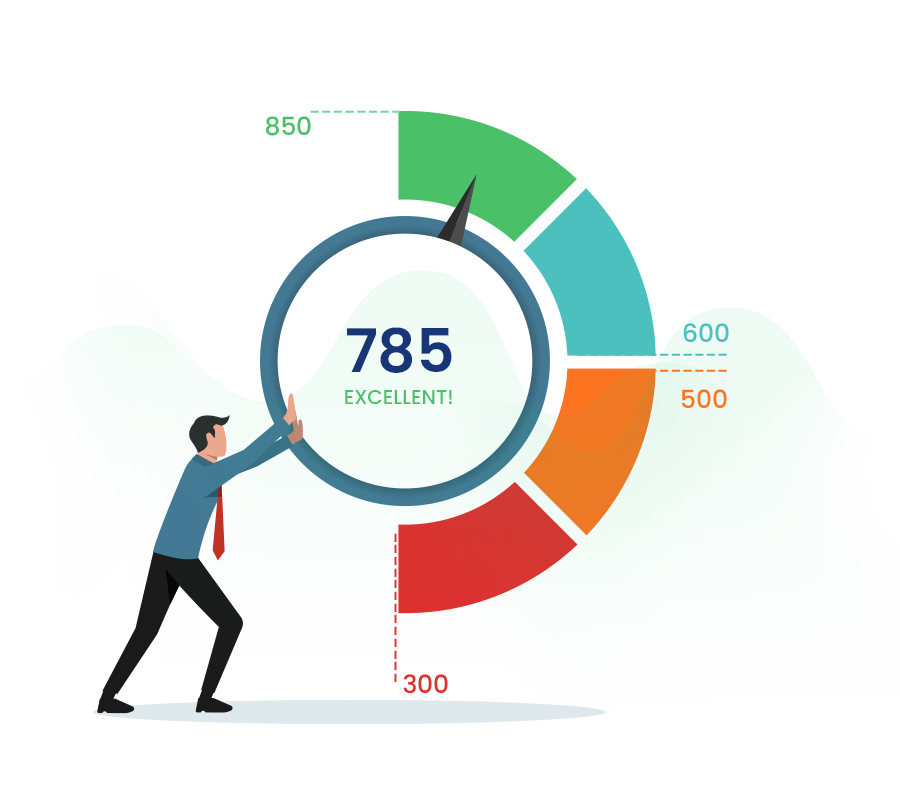

Credit 360 Service is the process of repairing a Credit score/credit history or removing negative flags from your profile and making you credit available.

Fincover is your trusted partner on the journey to credit score improvement, offering tailored services designed to elevate your financial standing and open doors to a brighter tomorrow.

The process involves comprehensive examination of your credit report, our experts meticulously review credit histories, identify errors, discrepancies, or areas requiring improvement. Our services go beyond identifying credit report errors; they formulate tailored strategies to rectify and enhance credit profiles to ease your future financial risks.

How our Credit360 Services work?

Credit report analysis

Once you approach us, we generate your Credit Report and come up with a detailed plan on the factors that are affecting your credit report and thereby your credit eligibility

Tailored Strategy

Once we spot the issues, we create personalized strategies to fix them. We take each and every customer on a case-by-case basis and come up with unique strategies

Personalized expert assistance

We have a specific credit expert allotted to each user. The credit experts understand the credit profile of each customer and provide tailored strategy to improve your credit score

Raise Dispute

We raise the dispute with the credit bureaus. It might involve fixing errors and negative flags representing you online and fixing the issues. Fixing errors is important for your credit opportunities

Tracking Progress

We provide regular updates on your progress. We keep you intimated all the time. This helps you see how your credit score is improving over time, giving you a clear picture of the impact of their efforts.

Financial Opportunities

We make sure our work fetches the right kind of results for you. Aside from boosting your credit score, we will also make sure you get better deals on interest rates on financial products

Suggested Read – How Is My Credit Score Calculated?

Common types of Credit Report Errors

- Incorrect Personal Information: Misspelled names, inaccurate addresses, or incorrect contact information are some of the common errors

- Negative Flags: Written off, PO settled, Suit filed are some of the common negative flags. They can be fixed by making repayment to the bank. Post which, the status will be moved to closed. It is very important factor contributing to pulling your credit score down.

- DPD: Date Past Dues: This records the number of days an EMI is paid after due date. If the borrower happens to fail to repay even on a single installment, the DPD will remain in your report for three years. Genuine DPDs entered cannot be removed. However, if there is a wrong mention of DPD, we can fix them.

- Closed Account errors: There might be errors in the closed credit card accounts that hampers your credit score. This happens due to not following the due courses involved in closing a credit card or even might be traced to company’s negligence. Some reports show Overdue even for Paidoff accounts.

- Duplicate entries: Duplicate reporting of the same account that can affect your credit utilization ratio and can impact your overall credit score. For example, you may see a credit card related entry twice which may lead to unnecessary complications.

- Identity Theft: Accounts opened fraudulently under your name and unauthorized credit inquiries can have an impact on your credit score. It is a serious issue that needs to be immediately prioritized and fixed

- Outdated Information: Credit reports may sometimes contain outdated information, such as closed accounts still being reported as open or negative information that should have been removed after the required period.

Fincover Credit360 Service Subscription

Annual Plan

- Credit score & Report

- Credit Profile Update

- Challenges to top 3 credit bureaus

- Score tracking & Analysis

- Identity theft Protection

- Financial Coaching & Debt Analysis

- Access to the credit dashboard

How long does it take for credit score repairing?

Unfortunately, we cannot predefine the time that it takes to fix credit issues. As each step in the credit score improvement process takes time. However, you can be assured that our team comprising credit report experts follow a streamlined and disciplined approach to credit improvement process by paying individual attention to each customer, so, we make sure we fetch you guaranteed results.

Our

Happy Customers Reviews

Kavya Nair

Anupama

Chandrahaasan

Nikhilesh

Kavya Nair

Anupama

Chandrahaasan

Nikhilesh

Kavya Nair

Anupama

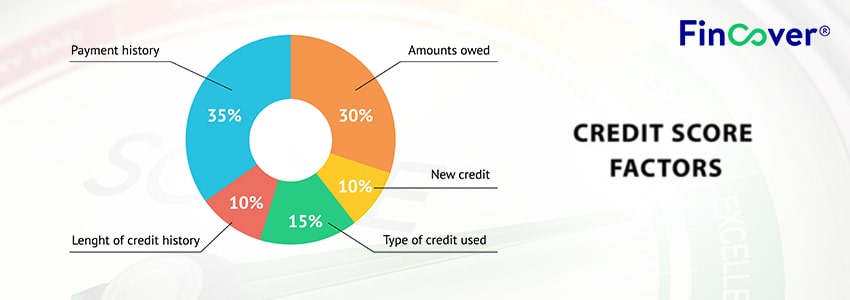

Credit Score How Is My Credit Score Calculated? Your credit score in India is a

Personal loans Mastering Credit Utilization: A Step-by-Step Guide Credit utilization is a crucial factor influencing

Personal loans Boost Your Credit Score: 7 Expert Tips A good credit score is essential

Personal loans Understanding DPD in CIBIL Report Your Credit Information Report (CIR) provided by Credit

Credit Repair Service Unlock your True Financial Potential with Credit360 Service Credit Score is beyond

Does PayPal Credit affect your credit score? Quick answer: PayPal Credit can affect your credit

Personal loans Boost Your Credit Score: A Comprehensive Guide to CIBIL Improvement in 2024 A

Credit Score How to fix errors in Credit report? Credit Report Error It is important

Credit Score Does late payment of credit card bills affect your credit score? At times,

Credit Score Credit Score for Home Loan A Own home is a dream of everyone

Credit Score Credit Score for Credit cards Want a credit card in 2024? Many of

Credit Score Credit Score for Business Loan Most businesses require funding at some stage of

Credit Score Credit Score For Personal Loan Personal Loans are unsecured loans. They are sanctioned

Credit Score How Is My Credit Score Calculated? Your credit score in India is a

Personal loans Mastering Credit Utilization: A Step-by-Step Guide Credit utilization is a crucial factor influencing

Personal loans Boost Your Credit Score: 7 Expert Tips A good credit score is essential

Personal loans Understanding DPD in CIBIL Report Your Credit Information Report (CIR) provided by Credit

Credit Repair Service Unlock your True Financial Potential with Credit360 Service Credit Score is beyond

Does PayPal Credit affect your credit score? Quick answer: PayPal Credit can affect your credit

Personal loans Boost Your Credit Score: A Comprehensive Guide to CIBIL Improvement in 2024 A

Credit Score How to fix errors in Credit report? Credit Report Error It is important

Credit Score Does late payment of credit card bills affect your credit score? At times,

Credit Score Credit Score for Home Loan A Own home is a dream of everyone

Credit Score Credit Score for Credit cards Want a credit card in 2024? Many of

Credit Score Credit Score for Business Loan Most businesses require funding at some stage of

Credit Score Credit Score For Personal Loan Personal Loans are unsecured loans. They are sanctioned

Credit Score How Is My Credit Score Calculated? Your credit score in India is a

Personal loans Mastering Credit Utilization: A Step-by-Step Guide Credit utilization is a crucial factor influencing

Personal loans Boost Your Credit Score: 7 Expert Tips A good credit score is essential

b.Negotiate debt settlements.

c.Dispute credit report errors.

d.Keep credit utilization below 30%.

e.Become an authorized user on someone's good credit card.

f.Get a credit builder loan.

g.Seek help from a credit counselor or financial advisor.

Your Journey Begins Here – Boost your credit score now

Take the first step towards a brighter financial future – explore our credit score improvement services today.

Don’t let your credit score curb your aspirations. Let Fincover be your mentor on the path to financial empowerment. Secure your tomorrow, starting today.