Credit Score For Personal Loan

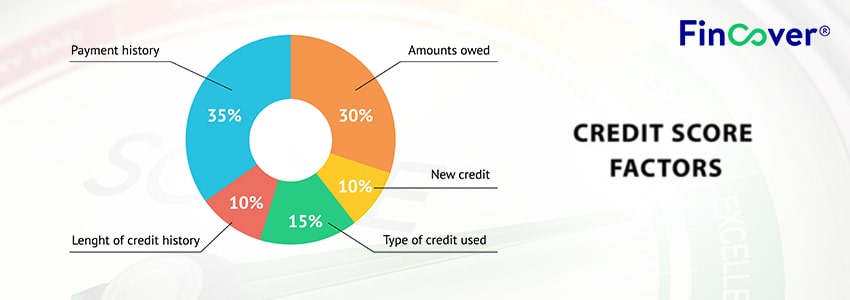

Credit Score Credit Score For Personal Loan Personal Loans are unsecured loans. They are sanctioned based on your repaying capability. Unlike other loans where you keep things as collateral, personal loans do not ask for any of these collateral. A personal loan is sanctioned based on your credit score. The higher credit score you have, […]