Top 10 RBI-Approved Loan Apps In India 2024

Discover the best loan apps in India that have partnered with RBI Approved NBFCs, offering instant personal loans, hassle-free approvals, and flexible repayment options

Trusted Loan Apps in India Partnered with RBI Approved NBFCs

India has experienced a massive boom of the digital lending market in the last few years with various loan applications that claim to provide instant credit. While this increase in popularity is positive for businesses and consumers, it has also raised issues concerning the customer security, transparency, and ethical practices about lending. As with many things in today’s world, there are apps that are genuine and helpful and those which are shady and work with unethical business practices and usurious interest rates. This article is meant to help borrowers navigate the complexity of choosing the best and safest loan apps in India with special emphasis on those apps affiliated with NBFCs that are registered with the RBI.

Popular Loan Apps in India Registered with RBI

| App Name | Loan Amount | Interest Rate (p.a) | Tenure |

|---|---|---|---|

| Fincover(Upcoming) | Upto ₹40,00,000 | From 10.49% | Upto 7 Years |

| Finnable | ₹50,000 – ₹10,00,000 | 16% – 26% | 6 months – 60 months |

| Bajaj Finserv | ₹25,000 – ₹50,00,000 | 10% – 32% | 6 months – 96 months |

| Tata Capital | ₹40,000 – ₹35,00,000 | From 11.99% p.a. | Upto 6 years |

| Lendingkart | ₹50,000 – ₹2 Crores | 1.25% p.m. | Upto 36 months |

| PaySense | ₹5,000 – ₹5,00,000 | 16.8% – 27.6% | 3 months – 5 years |

| Fibe (EarlySalary) | Up to ₹5,00,000 | 12% p.a. | 3 – 36 months |

| BuddyLoan | ₹10,000 – ₹15,00,000 | From 11.99% p.a. | 6 months – 5 years |

| FlexiSalary | Up to ₹3,00,000 | Up to 36.5% p.a. | Upto 36 months |

| DigiMoney | ₹10,000 – ₹1,00,000 | 10% – 24% | 3 – 12 months |

| PhonePe Loan | ₹5,000 – ₹5,00,000 | 13% – 20% p.a. | Upto 60 months |

| KreditBee | ₹1,000 – ₹5,00,000 | 17% – 29.95% p.a. | 3 months – 24 months |

| Dhani | ₹1,000 – ₹15,00,000 | From 13.99% | 3 months – 24 months |

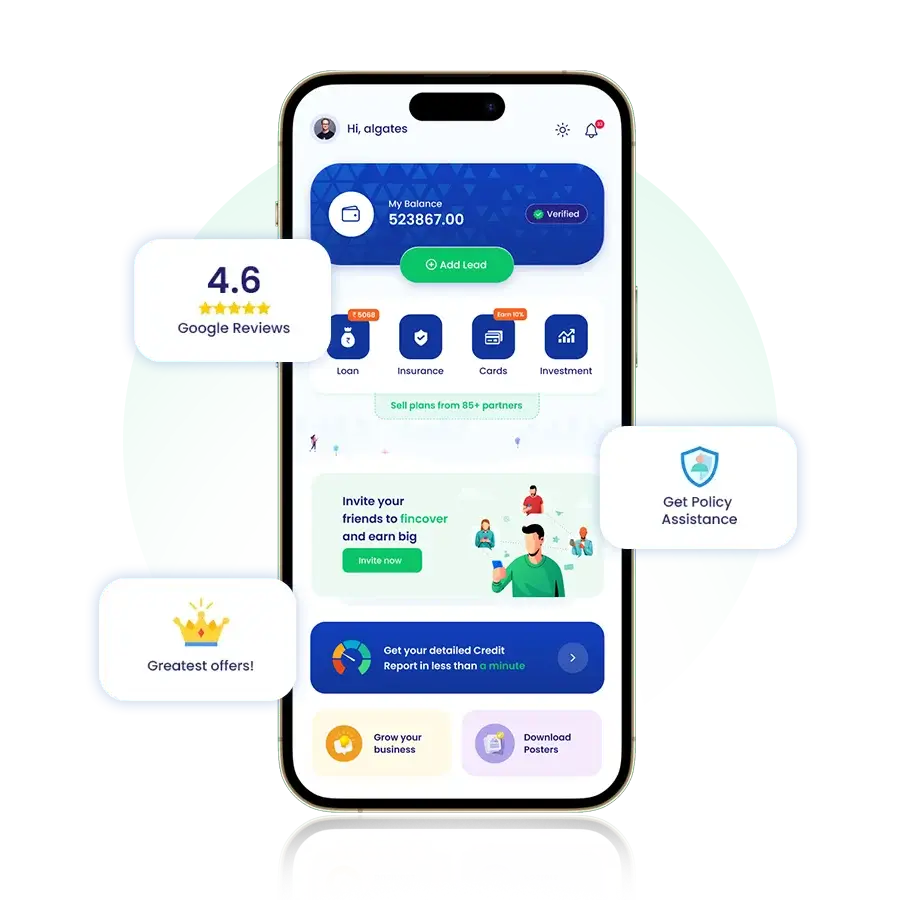

Fincover (Upcoming)

- Loan Amount: Up to ₹40,00,000

- Interest Rate: Starting from 10.49% per annum

- Tenure: Up to 7 years

Fincover is an upcoming Financial Marketplace or Aggregator app offering large loans with competitive interest rates for various financial needs.

Finnable

- Loan Amount: ₹50,000 to ₹10,00,000

- Interest Rate: 16% to 26%

- Tenure: 6 months to 60 months

Finnable provides fast approval and flexible terms, ideal for personal and professional requirements.

Bajaj Finserv

- Loan Amount: ₹25,000 to ₹50,00,000

- Interest Rate: 10% to 32% per annum

- Tenure: 6 months to 96 months

Bajaj Finserv offers extensive tenure options and high-value loans with tailored interest rates.

Tata Capital

- Loan Amount: ₹40,000 to ₹35,00,000

- Interest Rate: Starting from 11.99% per annum

- Tenure: Up to 6 years

Tata Capital is known for its simple application process and medium to high-value loans.

Lendingkart

- Loan Amount: ₹50,000 to ₹2 crores

- Interest Rate: 1.25% per month

- Tenure: Up to 36 months

Lendingkart specializes in business loans, offering high-value funding with competitive monthly rates.

PaySense

- Loan Amount: ₹5,000 to ₹5,00,000

- Interest Rate: 16.8% to 27.6% per annum

- Tenure: 3 months to 5 years

PaySense provides quick loans with minimal paperwork for smaller personal needs.

Fibe (EarlySalary)

- Loan Amount: Up to ₹5,00,000

- Interest Rate: 12% per annum

- Tenure: 3 to 36 months

Fibe is a great option for short-term financial needs with easy eligibility criteria.

BuddyLoan

- Loan Amount: ₹10,000 to ₹15,00,000

- Interest Rate: Starting from 11.99% per annum

- Tenure: 6 months to 5 years

BuddyLoan offers loans for various purposes, including medical and education, with competitive rates.

FlexiSalary

- Loan Amount: Up to ₹3,00,000

- Interest Rate: Up to 36.5% per annum

- Tenure: Up to 36 months

FlexiSalary is designed for salaried professionals needing short-term financial assistance.

DigiMoney

- Loan Amount: ₹10,000 to ₹1,00,000

- Interest Rate: 10% to 24%

- Tenure: 3 to 12 months

DigiMoney provides small loans for immediate expenses with flexible short-term options.

PhonePe Loan

- Loan Amount: ₹5,000 to ₹5,00,000

- Interest Rate: 13% to 20% per annum

- Tenure: Up to 60 months

PhonePe Loan offers convenient personal loans with moderate interest rates for diverse needs.

KreditBee

- Loan Amount: ₹1,000 to ₹5,00,000

- Interest Rate: 17% to 29.95% per annum

- Tenure: 3 to 24 months

KreditBee is ideal for smaller, quick loans with flexible repayment options.

Dhani

- Loan Amount: ₹1,000 to ₹15,00,000

- Interest Rate: Starting from 13.99%

- Tenure: 3 to 24 months

Dhani offers easy-to-apply loans for a wide range of financial needs.

Current Condition of Loan Apps in India

In its current form, the Indian loan app market looks somewhat ambivalent. On one hand, it provides exceptional convenience and relatively fast access to funds for the borrowers. Such apps cut the application process and offer instant approval, as well as, the funds are credited fast. On the other hand, the business practices of these loan apps are questionable. It is important to choose the loan app wisely. This accessibility is of great importance for anyone requiring some capital which may be needed right away

The biggest concern is the number of illicit apps that use loan applications to engage in abusive lending practices. Most of these apps usually have hidden charges, extraordinarily high interest rates, and harsh ways of debt collection that enslaves borrowers. Due to absence of proper disclosure and government policies required for reasonable market control has fuelled concern about data privacy. The Central Bank of India known as the Reserve Bank of India (RBI) has framed guidelines and policies to oversee the operations of non-bank players to increase the sector’s transparency and protection of the consumer. The most important of them is all that it mandates all loan apps must operate in partnership with existing NBFCs or banks. Borrowers must ensure that they secure funds only from apps that are in partnership with RBI authorized NBFCs to ensure they do not land up in trouble. Examples include Fincover, India’s best online marketplace, Bajaj Finserv, PaySense, and Lendingkart, which offer safe, reliable, and transparent financial solutions.

Benefits of Loan Apps Working with RBI-Registered NBFCs

- Trust and Reliability: NBFCs registered under RBI guidelines have their own set of rules and regulation protecting borrowers from shady operations.

- Data Protection: Such loan apps employ encrypted technologies that ensure that the data of the users are always safe and conform to data privacy acts.

- Fair Lending Practices: The borrowers can rest assured that they can avail a loan with a moderate interest rate, clear fee structure, and moral ways of debt collection.

- Wide Range of Services: Personal loan apps tied up with NBFCs offers solutions as personal loans, business loans, small loans and credit line services among others.

- Credit Inclusion: A good number of these apps provide credit to those with little to no record, and the more they borrow, the better they create their credit record.

- Data Security: RBI-registered NBFCs adhere to stringent data privacy regulations, ensuring that your data is in safe hands

- Credibility: Association with a reputable NBFC increases the credibility of the app, as RBI registered app would not partner with predatory apps

How to ensure Loan app is secure and legitimate?

To ensure the loan app you choose is secure and legitimate, follow these steps:

- Check for RBI Partnership

- Check in the app’s website whether it is registered with RBI

- Alternatively, you can also Cross-check the NBFC’s registration details on the RBI website.

- Review App Permissions

- Do not give unnecessary permissions to apps

- Make sure that the app conforms to data protection standards in India.

- Charges and Fees

- Ensure that the app has displayed transparent information on interest rates, fees, and penal charges

- Ignore apps that do not disclose these charges or has any hidden fees

- Research Reviews

- Check for user experiences using reviews

- Look for any potential red flags highlighted in the review

- NBFC list

- Check the list of NBFCs the app has partnered with to distribute their products. Ensure they are authorized by RBI

- Customer Support

- Ensure that the app has a proper customer support system in place with options to reach them through call, email, and chat

FAQ on Loan Apps partnering with RBI authorized NBFCs

1. Are all these loan apps trustworthy?

No, only loan apps which involve with RBI affiliated NBFCs or banks are safe as they operate according to the RBI rules and regulation.

2. How can I check if a loan app operates in association with an RBI registered NBFC?

Visit the app’s website to verify if it is registered or visit RBI’s NBFC list of registered entities. Original apps regularly reveal their NBFC partner information to the public.

3. Are there hidden fees in the RBI-registered NBFC loan apps?

Loan apps registered with NBFCs certified by RBI are not allowed to charge any fee, hide charges, or offer any interest rate or any term without first communicating it to the borrower clearly before the borrower is approved.

4. What kind of loans can I get through these apps?

You can get a range of loans from personal loans, business loans, and consumer durable loans depending on the app you chose

5. Are loan apps working with NBFCs secure for my data?

Yes, RBI regulations mandate strict data protection measures’ ensuring your information is not misused under any circumstances

Conclusion

Loan apps in collaboration with NBFC registered with RBI are bringing about shift in the credit market of India by providing safe way to borrow. All these applications offer many different credit products to cover personal emergencies and business development, and meet all the requirements necessary for proper legal regulation. In conclusion, reasonable precautions are the key for borrowers as new loan app platforms emerge: to avoid scams, the borrower has to keep vigil while shortlisting the app to ensure they follow all the practices as listed above

NBFCs

- Rs.50 lakh Personal Loan

- Rs.40 lakh Personal Loan

- Rs.30 lakh Personal Loan

- Rs.25 lakh Personal Loan

- Rs.20 lakh Personal Loan

- Rs.15 lakh Personal Loan

- Rs.10 lakh Personal Loan

- Rs.5 lakh Personal Loan

- Rs.4 lakh Personal Loan

- Rs.3 lakh Personal Loan

- Rs.2 lakh Personal Loan

- Rs.1 lakh Personal Loan

- Rs.50,000 Personal Loan

- Personal loan for salaried

- Personal loan for self-employed

- PL for IT Professionals

- Personal Loan for CA

- Personal Loan For Marriage

- Personal Loan For Women

- Personal Loan for Doctors

- Personal Loan for Pensioners

- PL for Defence Personnel

- Personal Loan for Low Salary

- PL for Home Renovation

- PL for Medical Emergency

- Personal Loan for NRI

- Personal Loan for CA