About Us

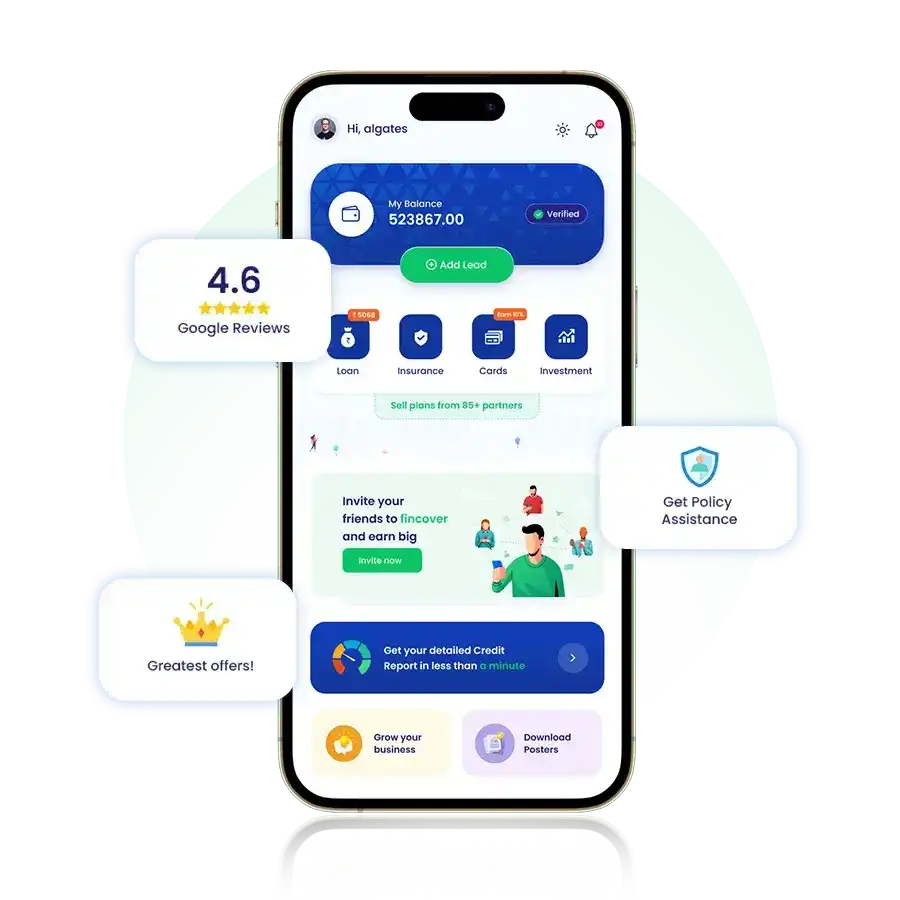

Empowering financial freedom, Fincover revolutionizes how individuals view finance. With innovative solutions and cutting-edge technology, we simplify financial complexities for all.Deeply Committed towards inclusivity and accessibility, we strive to democratize financial services.

we’re here to empower you to achieve your financial goals, every step of the way. Fincover provides a platform that enables the user to search and locate the best financial products suited to their needs and wants. We have partnered with India’s leading insurers (23 insurance), 50+ banks and NBFCs, and 35 + Mutual Fund companies to distribute their products.

Advantages

Customers can get started in no time after registering with our seamless onboarding policy!

The process is completely online. Say goodbye to tedious documentation & save a lot of time & money!

From onboarding and purchase to claim support, we would be glad to assist you at all times!

100% authentic, licensed and certified by IRDAI and AMFI

Simple, hassle-free site offering a complete financial experience

We are committed to safeguard your data with safety protocols

Dedicated customer support who will guide you through every step

Values We Provide

Across the Industry

we are blessed

Insurance agent

Content Strategist

Video Game Writer

Nursing Assistant

Video Game Writer

Film Critic

Questions You Have