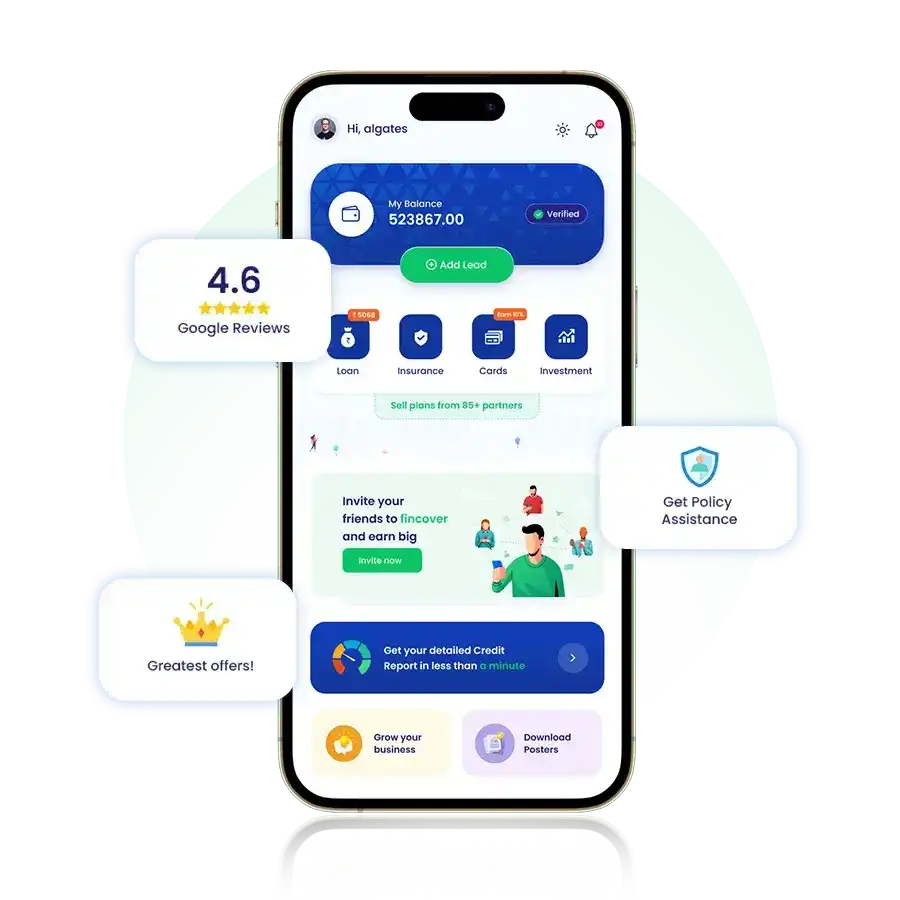

Empowering financial freedom, Fincover revolutionizes how individuals view finance. With innovative solutions and cutting-edge technology, we simplify financial complexities for all.Deeply Committed towards inclusivity and accessibility, we strive to democratize financial services.

we’re here to empower you to achieve your financial goals, every step of the way. Fincover provides a platform that enables the user to search and locate the best financial products suited to their needs and wants. We have partnered with India’s leading insurers (23 insurance), 50+ banks and NBFCs, and 35 + Mutual Fund companies to distribute their products.